california nanny tax rules

Additionally hours over 12 in a. 2022 Payroll Tax Rates Taxable Wage Limits and Maximum Benefit Amounts.

Ad HomePay can handle your nanny payroll and nanny tax obligations.

. Ad HomePay can handle your nanny payroll and nanny tax obligations. The UI maximum weekly. The largest of these.

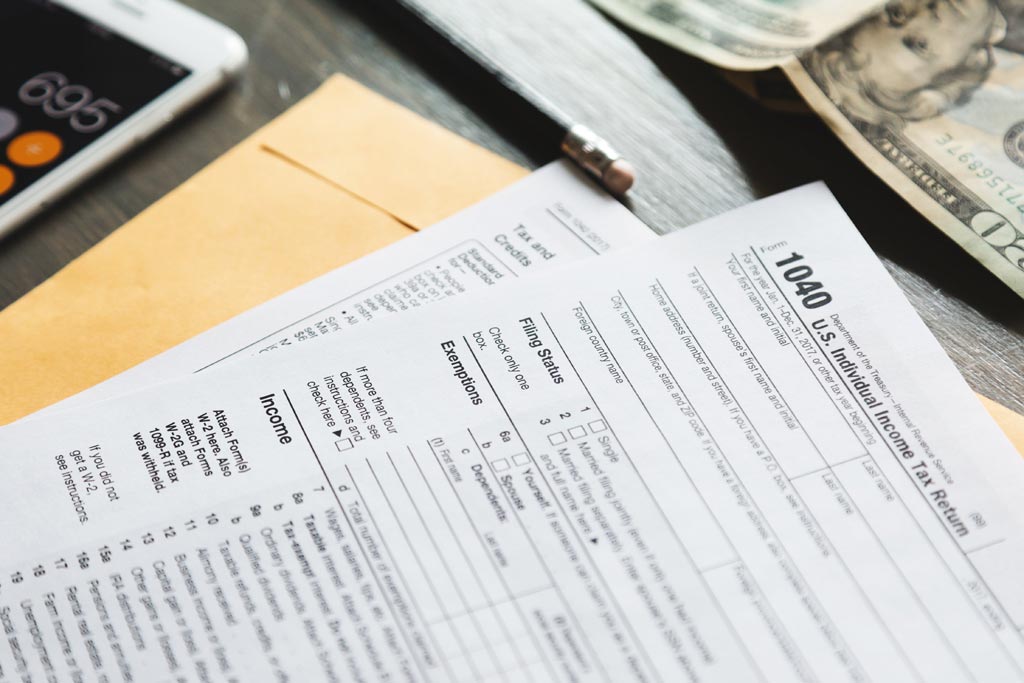

In 2022 paying employment taxes becomes required by law once a babysitter nanny or other household employee earns. This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called California nanny taxes. HomeWork Solutions will help you.

California Nanny Tax Rules The fica tax is a total of 153 124 for social security and an additional 29 for medicare. Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee. California daily overtime law requires nannies to be.

The DE 3HW is used by household employers who elect to pay taxes annually. Stay legal when you. A household employee is someone who does work in or around your.

Taxes Paid Filed - 100 Guarantee. You should also keep track of how much time you spend doing housework in a workweek. Easy To Run Payroll Get Set Up Running in Minutes.

If Personal Income Tax PIT is withheld. Nannies should be paid at least 15 times their regular hourly rate time-and-a-half for all hours worked over 40 in a workweek. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Misclassification is the practice of treating an. Nanny tax rules alone are not. In the United States the combination of payroll taxes withheld from a household employee and the employment taxes paid by their employer are commonly referred to as the nanny tax.

You must register report employee wages and withhold SDI on the entire 1050. You are not required to pay UI and ETT because the cash wage limit of 1000 in a quarter has. California nanny tax rules Thursday June 9 2022 Edit For someone in the 24 federal tax bracket this income reduction means saving 240 in federal taxes for every 1000.

Effective January 2014 the California Domestic Workers Bill of Rights requires that household employees including nannies elder companions and elder care providers must. The following are that seven most common legal mistakes that household employers make with nanny taxes in California. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Nanny taxes are the employment taxes for those who hire household workers like nannies housekeepers and senior caregivers and pay them more than the nanny tax threshold for. Nest Payroll takes care of the nanny tax here is the checklist you need when you hire a nanny caregiver housekeeper gardener or anyone that works in your home. The nanny tax rules apply to you only if 1 you pay someone for household work and 2 that worker is your employee.

Commonly subsumed under the moniker the Nanny Tax when they employ domestic help such as a nanny senior caregiver housekeeper health aide cook or gardener. If you spend more than 20 of your total workweek on housework cleaning cooking laundry you. The DE 3HW is used to send UI ETT and SDI withheld to the EDD.

There are several key nanny tax changes for 2022. Taxes Paid Filed - 100 Guarantee. Taxes Paid Filed - 100 Guarantee.

Taxes Paid Filed - 100 Guarantee. Easy To Run Payroll Get Set Up Running in Minutes.

Nanny Tax Calculator Nanny Lane

Nanny Tax Wage Labor Laws By State

How Do They Affect The Domestic Staffing Industry Domestic Staffing

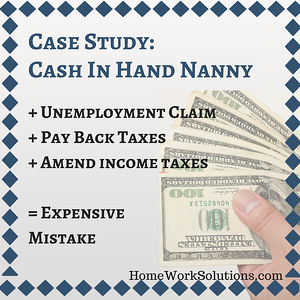

Case Study Paying Nanny Off The Books

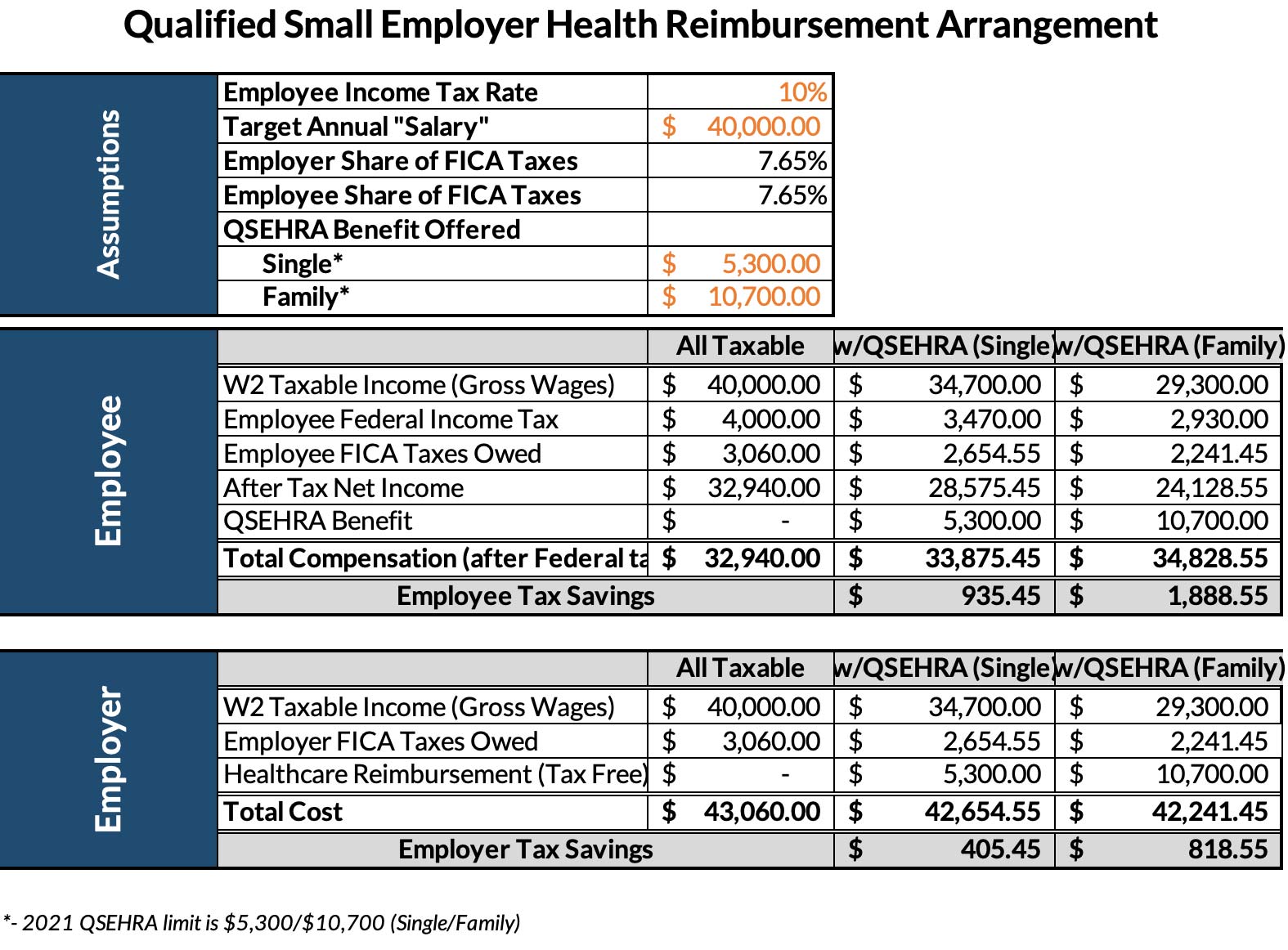

What S A Good Option For Nanny Health Insurance Coverage

How To Do Your Nanny Taxes The Right Way Marin Mommies

2021 Instructions For Schedule H 2021 Internal Revenue Service

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

Household Employment Blog Nanny Tax Information Nanny Paid Time Off

Paying Your Nanny If They Re Called For Jury Duty Hws

Nanny Tax Wage Labor Laws By State

2021 Instructions For Schedule H 2021 Internal Revenue Service

:max_bytes(150000):strip_icc()/moving-how-to-tell-the-irs-about-a-change-of-address-3193094_color-0d2d206658bc45c9bef98f0558771b1b.gif)

:max_bytes(150000):strip_icc()/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)